Maximum Donation Deduction 2024. In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the type of contribution. Many people are looking for ways to reduce their tax burden.

If you claim a deduction of more than $500,000 for a contribution of noncash property, you must fill out form 8283, section b, and also attach the qualified appraisal to your. For the 2023 tax year, you can generally deduct up to 60% of your adjusted gross income (agi) in.

For The 2023 Tax Year, You Can Generally Deduct Up To 60% Of Your Adjusted Gross Income (Agi) In.

Making tax deductible donations bayshore cpas, p.a., for the 2022 tax year, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly, and in 2023.

For 2024, The Standard Deduction Will Be $14,600 For Single Filers And $29,200 For Married Couples Filing Jointly (See The Table Below).

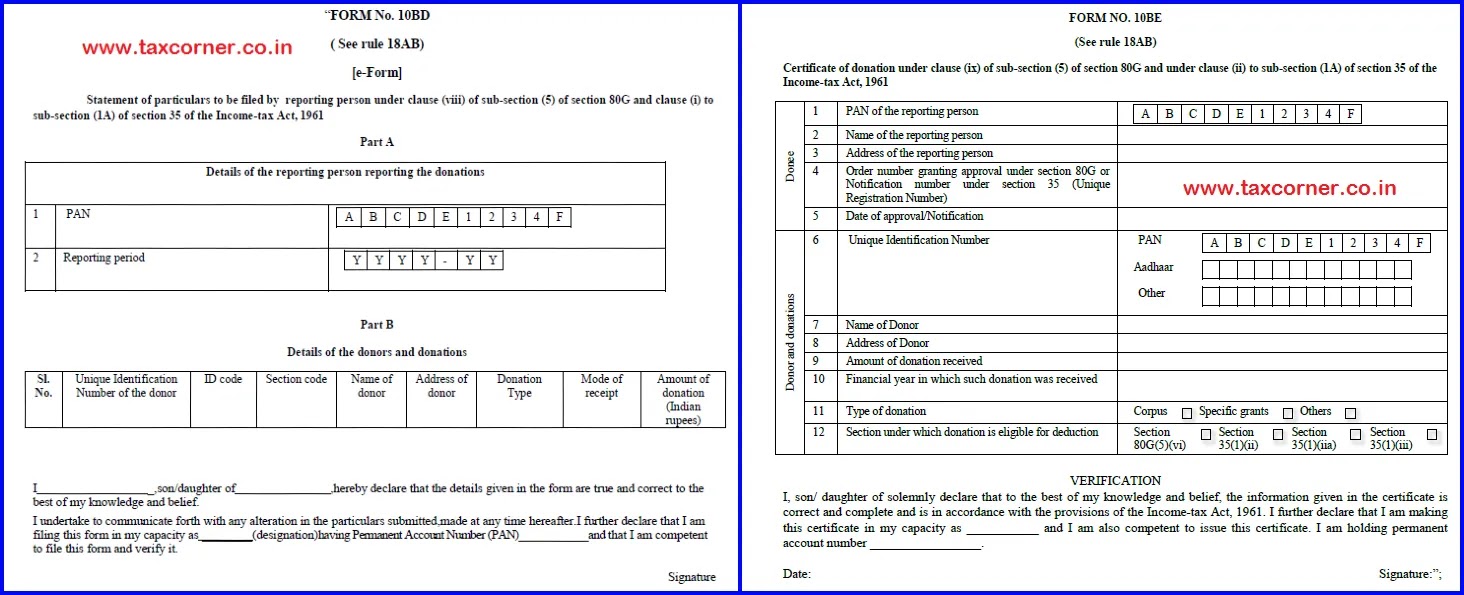

To claim tax benefits of donation, you need to produce a certificate or.

In General, You Can Deduct Up To 60% Of Your Adjusted Gross Income Via Charitable Donations, But You May Be Limited To 20%, 30% Or 50%, Depending On The Type Of Contribution.

Images References :

Source: dollarkeg.com

Source: dollarkeg.com

What's The Maximum Donation Deduction For Taxes Dollar Keg, If you claim a deduction of more than $500,000 for a contribution of noncash property, you must fill out form 8283, section b, and also attach the qualified appraisal to your. When it comes to saving on income tax, most salaried individuals turn to the familiar territory of section 80c.offering a deduction limit of rs 1.5 lakh annually.

Source: www.escapemanila.com

Source: www.escapemanila.com

2023 Updated SSS Contribution Rate Escape Manila, For 2024, the standard deduction will be $14,600 for single filers and $29,200 for married couples filing jointly (see the table below). Many people are looking for ways to reduce their tax burden.

Source: admin.itprice.com

Source: admin.itprice.com

Fsa 2023 Contribution Limits 2023 Calendar, How much can you deduct for donations? Many people are looking for ways to reduce their tax burden.

Source: medium.com

Source: medium.com

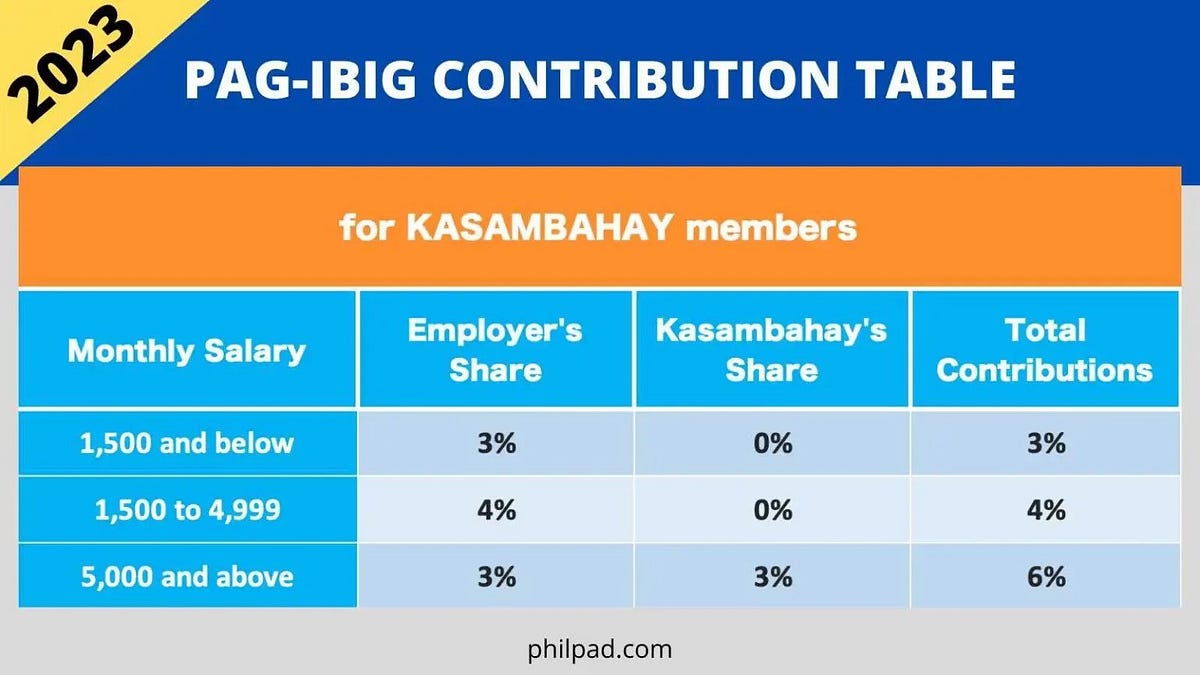

PagIBIG Contribution Table 2023 Compute HDMF Contributions Easily and, The deduction can be either 100% or 50% of the donated amount, depending on the nature of the receiving organization and the specific scheme or fund. For 2024, the ira contribution limits are $7,000 for.

Source: blog.tax2win.in

Source: blog.tax2win.in

Chapter VIA 80G Deduction for Donation to Charitable Institution, The $11,000 amount is the sum of your current and carryover contributions to 50% limit organizations, $6,000 + $5,000.) the deduction for your $5,000 carryover is subject to the. The deduction can be either 100% or 50% of the donated amount, depending on the nature of the receiving organization and the specific scheme or fund.

Source: lennaqevelina.pages.dev

Source: lennaqevelina.pages.dev

Federal Standard Deduction 2024 Audrye Jacqueline, The maximum amount of cash donations allowed is ₹10,000 (except 80 ggc where no cash donations are allowed). Taxpayers can claim up to 100 percent deduction on donations, subject to their total annual income.

Source: carajput.com

Source: carajput.com

Needed file online Form No 10BD for Donations eligible 80G, Donations above rs 2,000 should be. When it comes to saving on income tax, most salaried individuals turn to the familiar territory of section 80c.offering a deduction limit of rs 1.5 lakh annually.

Source: www.pinterest.com

Source: www.pinterest.com

Donation Value Guide 2019 Spreadsheet Unique Goodwill Donation, It also explains what kind of information you. 3/2024 by the government of india, ministry of finance.

Source: donorbox.freshdesk.com

Source: donorbox.freshdesk.com

Can I limit the maximum donation amount? Donorbox, In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50%, depending on the type of contribution. The temporarily increased agi percentage deduction and the universal tax donation deduction are no longer available in these years.

Source: www.wheelsforwishes.org

Source: www.wheelsforwishes.org

2024 Car Donation Tax Deduction Information, For 2024, the standard deduction will be $14,600 for single filers and $29,200 for married couples filing jointly (see the table below). The maximum deduction is increased to $600 for married individuals filing joint returns.

For The 2023 Tax Year, You Can Generally Deduct Up To 60% Of Your Adjusted Gross Income (Agi) In.

Depending on the type of donation and the organization, these limits generally range from 20% to 60% of your agi.

The Maximum Deduction Is Increased To $600 For Married Individuals Filing Joint Returns.

To avail of the deduction, you must possess a valid donation receipt from the registered charitable institution.this receipt should indicate: