Are The Electric Vehicle Tax Breaks A Write Off Meaning. You can get a $7,500 tax credit, but it won't be easy. It will be easier to get because it will be available as an instant rebate at dealerships, but.

Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. Business fleets (which include both government and.

Those Bands Are Frozen Until April 2025, Which Means Electric Vehicle Drivers Are Only Being Taxed Based On 2% Of The List Price Until That Date.

The federal ev charger tax credit for electric vehicle charging stations and equipment is back with a few key changes.

$150,000 For A Household, $75,000 For A Single Person.

But new provisions in 2022’s inflation reduction act have made the ev tax credit easier to claim.

However, The Tax Credit Works Differently.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

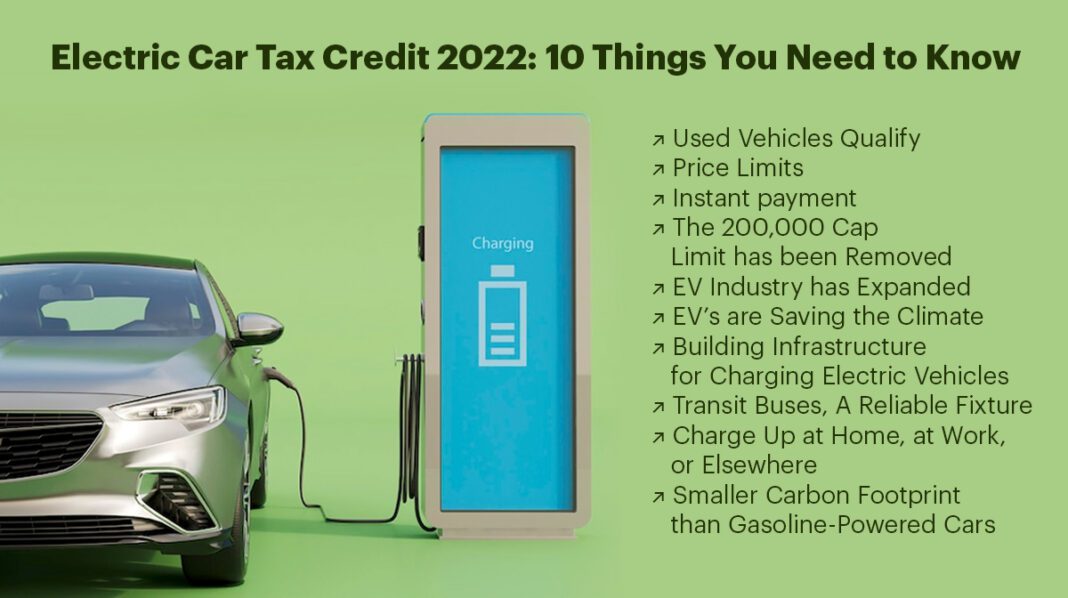

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, But new provisions in 2022’s inflation reduction act have made the ev tax credit easier to claim. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles.

Source: palmetto.com

Source: palmetto.com

Electric Vehicle Tax Credit Guide 2023 Update), For the first time in years, some teslas will qualify for a $7,500 federal tax credit for new electric vehicles. It's applied as a discount to one's federal income taxes, so its ultimate value hinges on the amount a person owes the government.

Source: 1800accountant.com

Source: 1800accountant.com

Electric Vehicle Tax Credit Explained 1800Accountant, The inflation reduction act also provides a new credit for previously owned clean vehicles to qualified buyers. Electric vehicle buyers can get up to $7,500 in tax savings right at the dealership, under changes to the law that went into effect jan.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, The irs now allows you to claim the ev tax credit for previously owned electric vehicles for purchases up to $25,000. Vehicles used for business purposes can often be written off using a few different tax deductions:

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, As of 2024, any qualified buyer can transfer their clean vehicle tax. The tax breaks linked to buying an electric car in india are intended to increase customer access to and attraction to these environmentally friendly substitutes.

Source: kbfinancialadvisors.com

Source: kbfinancialadvisors.com

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB, You can claim the credit yourself or. However, the tax credit works differently.

Source: electrek.co

Source: electrek.co

Here are the cars eligible for the 7,500 EV tax credit in the, To qualify for the new federal electric car. However, the tax credit works differently.

Source: getelectricvehicle.com

Source: getelectricvehicle.com

Electric Car Tax Credit Everything that You have to know! Get, Eligibility criteria individuals are the only ones who. It will be easier to get because it will be available as an instant rebate at dealerships, but.

Source: www.greenmatters.com

Source: www.greenmatters.com

A Complete Guide to the Electric Vehicle Tax Credit, Again, that's adjusted gross income, meaning an. The ev tax credit for new vehicles is either $3750 or $7500, but very few new vehicles now qualify.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What, It will be easier to get because it will be available as an instant rebate at dealerships, but. For the first time in years, some teslas will qualify for a $7,500 federal tax credit for new electric vehicles.

It's Applied As A Discount To One's Federal Income Taxes, So Its Ultimate Value Hinges On The Amount A Person Owes The Government.

Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles.

It Will Be Easier To Get Because It Will Be Available As An Instant Rebate At Dealerships, But.

The federal ev charger tax credit for electric vehicle charging stations and equipment is back with a few key changes.